How analytics can supercharge holiday retail sales

Thanksgiving weekend kicks off the holiday shopping season in the United States. And once more, retailers will compete for a share of consumers’ gift purchases.

Approximately 69 percent of Americans—about 164 million people—plan to shop this Thanksgiving weekend, according to the National Retail Federation’s annual survey conducted by Prosper Insights & Analytics. Overall, holiday shoppers plan to spend up to 3.4 percent more money on Black Friday and Cyber Monday than last year.

In a saturated holiday retail market, pricing isn’t the only factor influencing sales. A prime customer experience extends through store operations, product offerings, and promotions. But the competitive advantage lies in understanding how these factors work together—and this starts with data.

Timely events require timely, accurate data

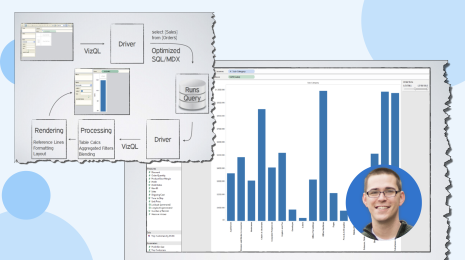

Promotional events live or die by ROI (return on investment). And to determine ROI, retailers are dependent on accurate, timely data. Before holiday shopping events like Black Friday or Cyber Monday, retailers must ensure that employees and leaders base critical decisions on a comprehensive view of the business instead of siloed data sources living in individual departments.

This requires a governed, self-service analytics strategy where stakeholders can access curated data sources, allowing teams like marketing and supply chain to spot outliers and adjust their strategy as events progress. If your data is fractured, incomplete, or static until it is processed by IT—or worse, if you don’t have access to data without manual intervention—you won’t compete with retailers tracking real-time metrics around sales, marketing campaigns, pricing, and customer feedback.

With real-time analysis, retailers can also spot issues as they happen. For example, if your e-commerce website experiences slow load times or if an item is listed at the wrong price, you can identify and fix the problem instead of finding out the next day when the window of opportunity has closed. Additionally, predictive analytics help retailers understand customer behavior from previous years to determine the optimal experience throughout the entire customer journey—from advertising to store layout.

Omni-channel calls for a 360-degree customer view

A retailer’s customer experience has a chance to shine in the face of events like Black Friday and Cyber Monday—and nowadays, shoppers expect a seamless retail experience across channels. This starts with a deep, comprehensive understanding of the customer.

A successful omni-channel strategy is built on a foundation of data. Leading retailers create comprehensive dashboards reflecting each stage in the customer journey, bringing in supply chain, sales, marketing, and engagement data into one view. This puts the customer at the forefront of a holiday promotional strategy instead of the other way around. Customer analytics will also drive personalized experiences, including adjustments to product offerings that cater to target demographics in different regions.

Analytics further shape important testing around things like mobile payments, optimized shopping interfaces, and digital promotions to determine the best customer experience. For example, Groupon uses A/B testing to optimize website structure, merchandising, and the mobile experience. A large department store uses A/B testing to measure email campaigns, ensuring proper content and placement. Another retailer uses A/B testing to measure conversion rates for the models that promote their online products, testing different poses and accessories. Photographers then conduct photo shoots with these results in hand. With consistent analytics tracking and refinement, retailers can continually improve the customer experience and achieve solid year-over-year growth.

Mobile-first approach requires optimization

According to a survey from RetailDive, 58 percent of consumers use mobile phones to research product information in stores and 40 percent use mobile phones to download digital coupons. This shows that a positive customer experience extends beyond just digital or just brick-and-mortar. Around the holidays when the retail market is flooded with sales and promotions, the differentiator will be how well companies tie the two experiences together.

A prime example is Alibaba, the highly successful Chinese e-commerce retailer that has been investing in brick and mortar to create a new retail landscape based in technology. Forbes shares how Alibaba established Hema Xiansheng supermarkets where shoppers “scan barcodes with the Hema app for product information and pay with the Alipay e-wallet.” With these vast amounts of data, Alibaba can understand buyer preferences and make recommendations both in store and on a shopper’s smartphone.

And it doesn’t stop there. Alibaba’s Single’s Day (their version of Cyber Monday) earlier this month raked in $25.3 billion in sales, up from $17.8 billion last year. According to Bloomberg, “About 90 percent of transactions [on Singles Day] were done via mobile.” This is a staggering number when one realizes that U.S. consumers spent $8.7 billion online on Thanksgiving, Black Friday, and Cyber Monday combined in 2016—and only about 30 percent of Black Friday shoppers used mobile checkout.

More U.S. companies are investing in mobile, as this year’s Black Friday is expected to hit national e-commerce records for mobile sales and engagement. Although the U.S. still lags behind China’s mobile sales, this upward progression shows that mobile is here to stay. Now is the time to establish a solid analytics strategy with mobile as a key performance indicator within your brand’s omni-channel experience.

Start analyzing your omni-channel impact with these Top 10 Retail Dashboards for Better Performance.