How Sompo Holdings Asia Built An Engaged, Collaborative And Data-Driven Workforce

Tableau adoption has grown from five employees to 200+ across eight countries

More than 20% improvement in turnaround times for claims settlement

Overall improvements in profits, including a 6% improvement for motor insurance

Sompo Holdings (Asia) Pte. Ltd. (Sompo Asia) is part of a leading global provider of property and casualty insurance. Headquartered in Singapore, the regional business operates across 14 markets with over 4,500 employees. Sompo employees share the business’ vision to bring happiness and more than just insurance to stakeholders. They are also increasingly data-driven.

“One of our core values at Sompo Asia is curiosity. Access to data through Tableau and empowering employees to ask questions has enabled many of my colleagues to challenge themselves and others. It also allows us to continually align everyone towards our strategic goals,” said Aditya Tibrewala, Chief Technical Officer of Sompo Asia. “As a result, we have become more focused, and there is more trust and confidence which are essential traits for creating a collaborative culture.”

We believed that unless top leadership and decision makers understood the benefits, it would be impossible to drive commercial outcomes, even if we were to implement the best available technology

Democratizing data gives rise to data culture

Availability and accessibility of data was previously a challenge for Sompo Asia. There was no single source of truth for information. Instead, most employees relied on IT to extract reports from systems using tools like SQL. The reports were not always easy for non-technical users to understand and any advanced analysis had to be carried out by actuarial teams.

Three years ago, the management decided they needed a solution that would empower all employees to harness the value of data. They chose Tableau as they wanted a strong foundation for data processing and management, visualization, and analytics. Tableau was also easy to scale, making it an ideal solution to roll out across different markets.

Sompo Asia’s implementation journey began with creating awareness about the benefits and power of business intelligence among senior leaders. “We believed that unless top leadership and decision makers understood the benefits, it would be impossible to drive commercial outcomes, even if we were to implement the best available technology,” said Aditya.

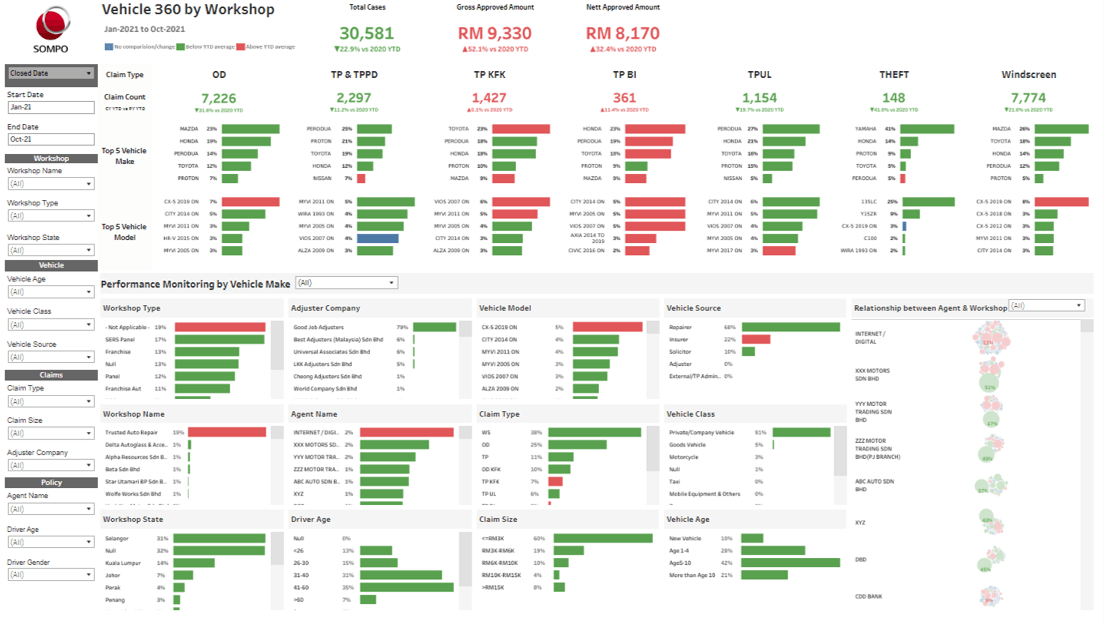

All data and information shown is simulated and doesn’t represent actual information

Awareness activities included sharing a case study on the motor claims. The team was one of the first to adopt Tableau and, by analyzing past claims data, they identified opportunities to increase efficiency. They also improved claims settlement turnaround times in some areas by 20% as a result.

Promoting success stories like these combined with structured training programs has helped Sompo Asia to grow its Tableau user base from just five people in one team to more than 200 in eight markets. These include employees in areas like sales, marketing, pricing, and underwriting in addition to claims.

“Data skills are widely required, though not readily available. Hence, it is crucial to find and empower people in the organization who love data, talk about it all day, and share it with everyone around them,” said Aditya.

Aditya added that bringing senior management into Sompo Asia’s data community made its transition to a data-driven business smoother and sustainable.

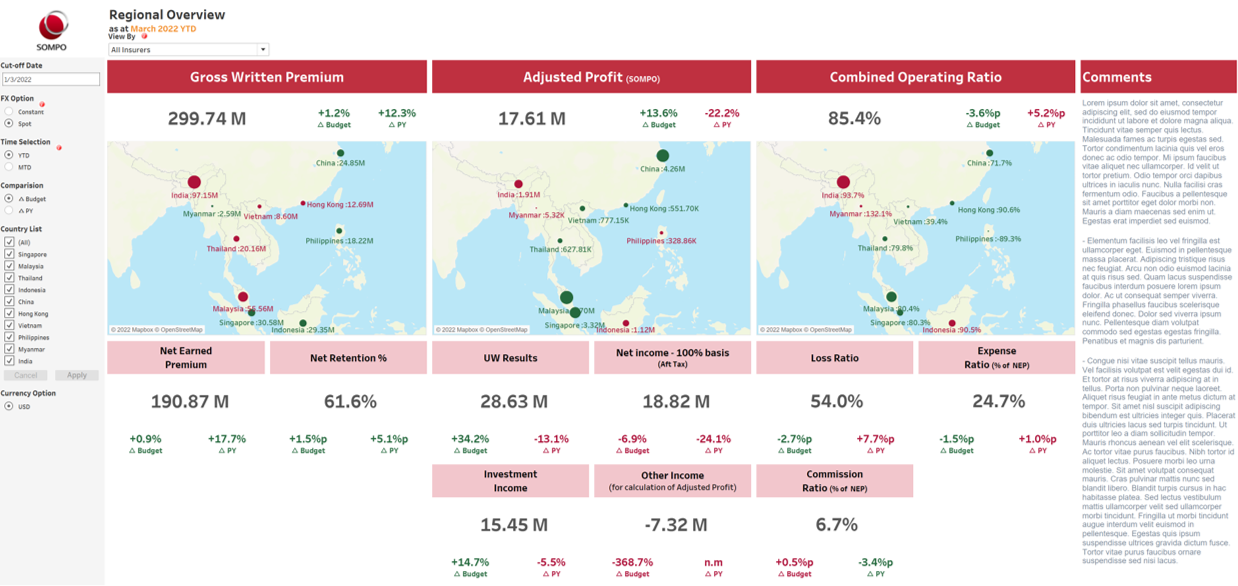

All data and information shown is simulated and doesn’t represent actual information

Single source of truth improves collaboration and bottom line results

Sompo Asia has created what it refers to as “One Source of Truth” using Tableau. This source of truth helps to create a common understanding between teams on what’s required to meet the goals and objectives of the business. For example, marketing and pricing teams can have more productive discussions about pricing based on factual data on competitor pricing and profitability.

In addition, Sompo Asia has adopted four key pillars for data-driven decision-making. These pillars include:

- Data Systems Architecture: Making data accessible and simplifying the experience for users

- Data Governance: Data quality, security and reach

- Data Analysis: Enabling and drawing insights for business usage

- Business Usage: Drive commercial outcomes

“Data removes ambiguity from discussions and speeds up the decision-making process, therefore driving more productivity and engagement in meetings,” said Aditya.

Sompo Asia now uses data to inform all kinds of decisions and to identify ways to improve the customer experience and growth. Tableau supports the business by simplifying analysis of financial, operational, industry, and policy and claims data. It is therefore easier to identify things like which segments are most profitable and subsequently change pricing or marketing strategies to increase market share.

The benefits of Sompo Asia’s data journey are reflected in its financial results. These include a more than 6% increase in profitability of motor insurance in some key markets.

Sompo Asia plans to build on these benefits with a focus on increasing Tableau usage amongst existing users first. It also sees data analytics evolving towards self-service and more automated intelligence.

“Data is even more critical for insurance companies as we not only use it for various operational and strategic reasons, but we rely on it to predict future outcomes. As the data structures and quality improve, more and more companies will be able to automate the insights that can be drawn,” said Aditya.