Online PSB Loans Leverages Embedded Analytics to Support Banks' Operational Performance Analysis

Embedded analytics enhances Online PSB Loan’s value proposition by helping banks optimize lending performance

21 public sector and private banks in India leveraging shared competitor intelligence

~3 months time to market post-finalizing data strategy for the initial set of dashboards

Online PSB Loans Limited is India's largest lending fintech. The company’s marketplace platform, ‘PSB Loans in 59 Minutes’, automates and digitizes the lending process, making it easier for both borrowers and lenders.

Founded in 2015, Online PSB Loans now has 95% of the country’s commercial banks on its platform and helps them to streamline approvals for several loan types, including business loans for Micro, Small & Medium Enterprises (MSMEs) and retail loans.

“It is a win-win for banks and borrowers as borrowers can see all of the available loan products on our platform and identify the one most suited to meet their requirements,” said Paresh Ashara, President of Analytics. “Once they receive in-principle approval for the loan, the rest of the process is easy and can be completed faster.”

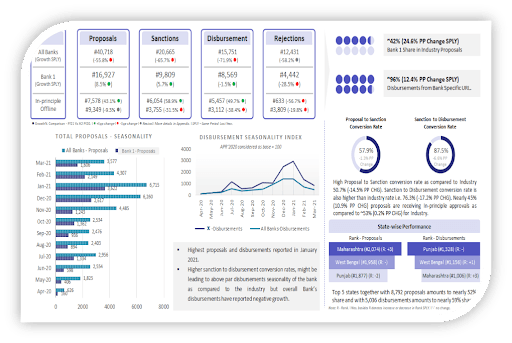

As part of its offering, Online PSB Loans provides banks with insights to help them manage their lending activities. Powered by Tableau embedded analytics, these insights include metrics such as number of applications vs disbursements as well as competitor analysis.

Paresh, who is responsible for all analytics and insight initiatives at Online PSB Loans, shared why the company had chosen Tableau embedded analytics to support its data strategy.

We had plans to take our solution to the next level and felt that Tableau could cater to these future needs, including the ability to generate insights on the run and add dynamic commentary.

Meeting demand for more insights

Online PSB Loans enables banks to facilitate loans through its marketplace and also offers a white label solution that banks can use to facilitate loans through their own portal or in-branch.

The company has always provided reporting to customers to support these offerings. It started with insights provided in the form of a PDF, but it was soon evident customers wanted more data points. Tableau embedded analytics made it possible to not only provide customers with more data, but to allow them to interact with dashboards and self-serve.

Paresh said that choosing an embedded analytics solution rather than building out its own helped the company to speed time to market. Online PSB Loans went live with the solution just two to three months after finalizing its data strategy.

“If we were to custom build an analytics solution there are a number of features and capabilities we would need to develop from the ground up in order to manage the data sets and perform calculations and statistical analysis. Tableau has all of these capabilities built in. It also provides us with flexibility in how we present our data and at the end of the day that's what really matters to our customers,” said Paresh.

The analytics team initially prepared three to four different dashboards to help banks track specific metrics. It has since expanded on these and created nearly thirty dashboards that provide banks with a more holistic view of their performance. For example, they can analyse performance of different loan products by volume and value and identify their top products. They can also easily view and compare performance across different time periods.

With the majority of the country’s commercial banks on its platform, Online PSB Loans has a wealth of industry data. The analytics team uses Tableau to analyse and share this information with banks as well. The market intelligence includes the ranking of banks in each product category and more granular insights such as the average time from application to approval and from approval to disbursement.

Equipped with all these insights, banks can make better decisions to improve their overall performance and the take up of loans.

With Tableau embedded analytics, we’re able to provide banks with very detailed and pointed insights that help them make decisions. For example, they may decide to replace an underperforming product or reassess its eligibility requirements.

Adding additional insights and value

Data analytics has become a core part of Online PSB Loan’s offering and the banks have appreciated the ability to consume data on their own using the Tableau dashboards. At the same time, they continually seek more insights to help them manage their business.

The analytics team has responded by preparing quarterly and annual reports with detailed commentary. The team has traditionally completed the analysis for the reports using Tableau before downloading dashboards and adding commentary offline. However, they will soon add commentary into Tableau dashboards directly. This will reduce the time spent preparing reports and enable banks to access the insights much faster.

Tableau’s embedded analytics and commentary from the analytics team helps banks to understand their lending performance and how they rank against competitors

Online PSB Loans is continuing to add value to banks and contributing to the country’s overall financial sector with solutions like a new portal where businesses and individuals can access loans subsidized by the government. The Tableau embedded analytics solution will form part of this offering in the future.