Tableau per i diversi settori

Analisi per il settore assicurativo

Offri una customer experience digitale, utilizza informazioni basate sui dati e gestisci il rischio

Analisi nel settore assicurativo: come una cultura basata sui dati accelera la leadership e l'innovazione

Scopri come Progressive, leader nel settore assicurativo e all'avanguardia nella tecnologia, nei dati e nell'analisi, ha creato una cultura aziendale basata sui dati e ha accelerato il percorso di trasformazione digitale grazie alle informazioni ricavate dall'intelligenza artificiale e alla business intelligence.

Guarda ora

Creare coerenza, rafforzare l'analisi del rischio e trasformare il settore assicurativo con i dati

Dal 1922 USAA fornisce servizi assicurativi e finanziari al personale militare e civile. Scopri come questa azienda leader del settore si affida al potere dell'analisi visiva per creare un riferimento centralizzato e prendere decisioni migliori e più rapide, ridurre i tempi di consegna dei report e favorire il successo nell'intera organizzazione.

Abbiamo adottato Tableau nel nostro gruppo di analisi e lo abbiamo condiviso con il resto dell'organizzazione, condividendo inoltre le visualizzazioni a livello dirigenziale. I dirigenti sono stati molto soddisfatti, e hanno iniziato a chiedere visualizzazioni più approfondite, fino al livello dei singoli gruppi e team. Coinvolgere i dirigenti e conquistare la loro fiducia è stato fondamentale per l'adozione di Tableau.

PEMCO incrementa il valore aziendale con una gestione dei risarcimenti più rapida e precisa e ottimizzando la gestione dei server

Scopri come PEMCO, una compagnia assicurativa rivolta ai privati, utilizza Tableau per seguire e monitorare con cura tutte le richieste di risarcimento, migliorando notevolmente i tassi di chiusura e ottenendo un alto livello di soddisfazione dei clienti.

Swiss Life diffonde la cultura dei dati e migliora il processo decisionale

Swiss Life, leader nelle soluzioni di assicurazione sulla vita, pensionistiche e finanziarie, ha messo i dati al centro della propria attività. Scopri come sta favorendo cambiamenti di grande impatto, migliorando i processi decisionali e adottando pratiche aziendali innovative.

Aon fornisce ai dipendenti analisi self-service rapide e accurate, in tutto il mondo

Aon, azienda leader nei servizi professionali a livello globale, propone numerose soluzioni di tutela contro i rischi, oltre che in ambito pensionistico e sanitario. Scopri come ha migliorato la fiducia nei dati, velocizzato l'analisi e ridotto i tempi di sviluppo con la sua piattaforma integrata principale basata su Tableau.

Altre

risorse

Soluzioni

Soluzione in primo piano

Trasformazione dei contact center finanziari con i dati

Come utilizzare i dati per differenziare il tuo contact center? Ecco quattro strategie che ti aiuteranno a trasformare la tua organizzazione di servizi grazie all'analisi.

Prodotti e

casi d'uso

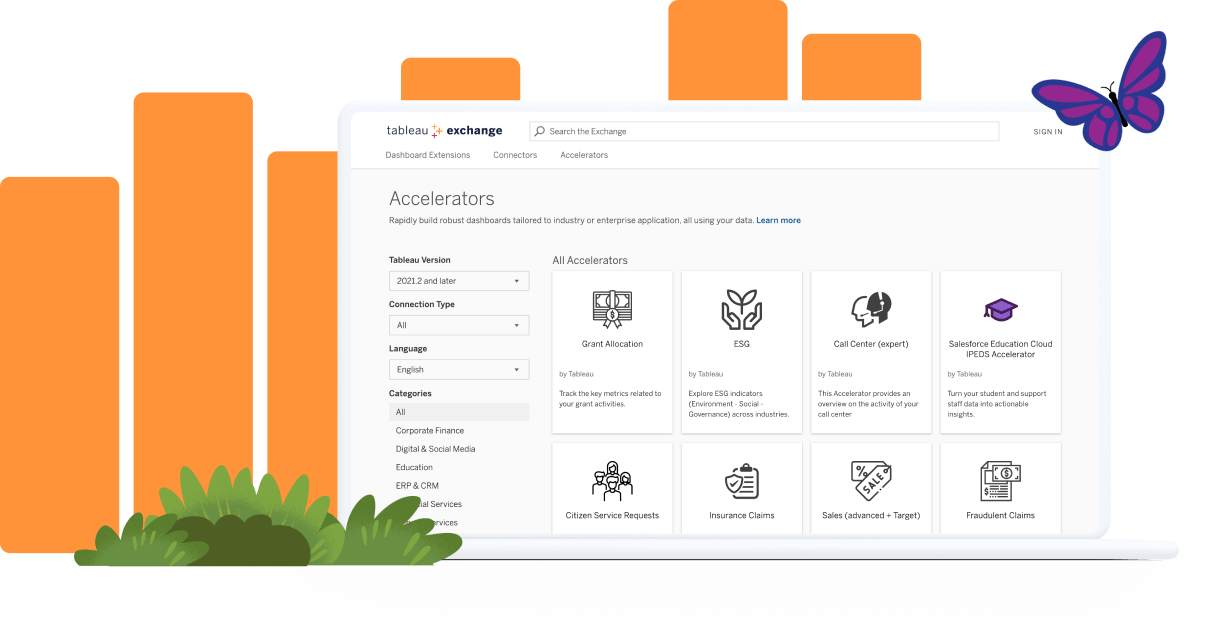

Inizia l'analisi alla grande con gli acceleratori di Tableau

Usa dashboard create da esperti per rispondere alle esigenze aziendali specifiche del settore assicurativo con gli acceleratori di Tableau Exchange.

Esplora gli acceleratoriWebinar e sessioni on-demand per il settore assicurativo disponibili a breve

Rete dei partner di Tableau

Ti serve aiuto per affrontare le sfide più impegnative legate ai dati? Ci siamo noi. Con oltre 1.200 partner tra rivenditori, fornitori di servizi e di tecnologia, è facile ottenere il supporto ottimale per la tua azienda.

Trova un partnerVisualizza i dati del settore assicurativo

Portale assicurazioni complementari volontarie

Scopri come i fornitori di assicurazioni complementari possono offrire un'esperienza differenziata ai datori di lavoro/sponsor dei piani, consentendo attività self-service, riducendo i costi della collaborazione e accelerando sul percorso che dai dati porta alle informazioni e quindi all'azione, per un maggiore NPS, tassi di partecipazione più alti e fidelizzazione dei partecipanti per l'operatore.

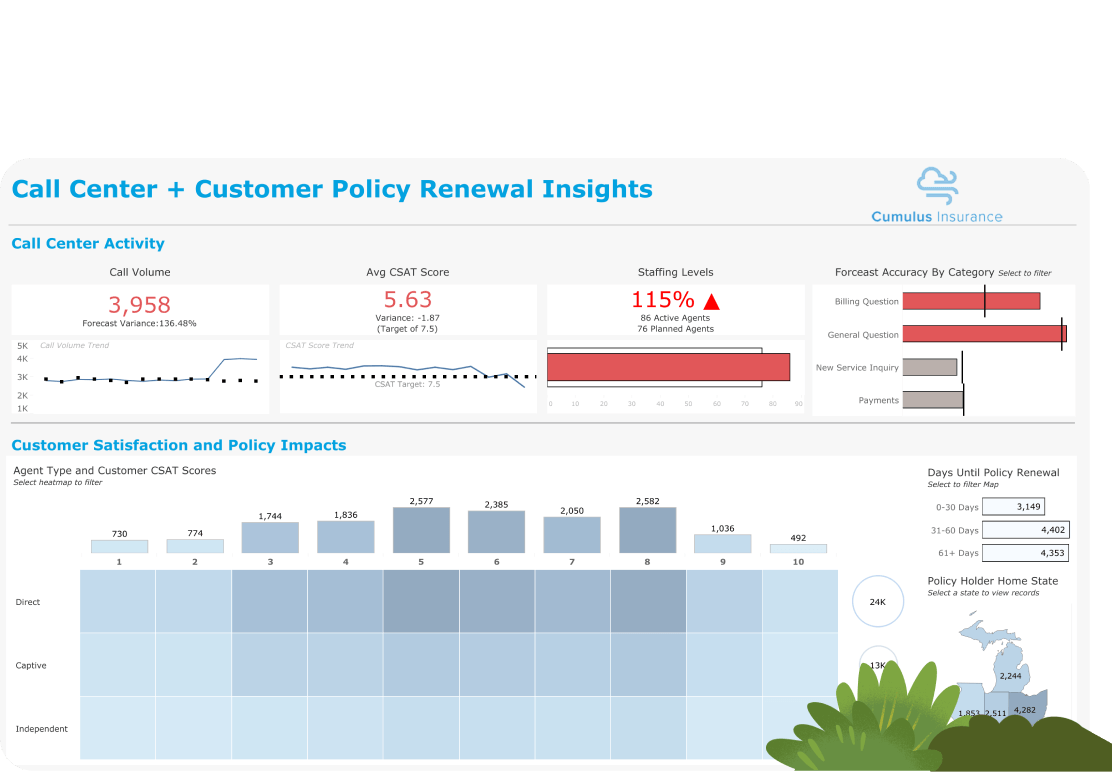

Esplora la visualizzazioneCall center e rinnovo polizze

Scopri informazioni fruibili sui call center e sul rinnovo delle polizze, per visualizzare e comprendere meglio il livello di soddisfazione dei clienti, gli impatti delle polizze, il volume delle chiamate e i livelli di allocazione del personale, per avere gli strumenti che favoriscono l'eccellenza operativa e il successo dei clienti.

Esplora la visualizzazione

Salesforce e Tableau

CRM Analytics è una piattaforma di intelligence completa, basata sulla piattaforma di CRM numero 1 al mondo: Salesforce. Offre un'esperienza di analisi nativa alle aziende del settore assicurativo. Gli utenti di Salesforce possono accedere a informazioni intelligenti e fruibili direttamente nel loro flusso di lavoro, per aumentare la produttività. Esplora le soluzioni di Salesforce per il settore assicurativo.