Rent Debt in America: Stabilizing Renters Is Key to Equitable Recovery

Visualizes data on who is behind on rent, and the estimated amount owed, based on the U.S. Census Household Pulse Survey.

Released on April 21, 2021, the dashboard data is refreshed regularly based on the Pulse survey updates.

Incorporates Emergency Rental Assistance data from the US Treasury into the “Relief Map” on the dashboard.

Designed to equip policymakers and housing advocates with data on the extent and nature of rent debt in their communities, PolicyLink and its community partners created this Rent Debt Dashboard to inform the local, state, and national advocacy to eliminate debt and prevent mass eviction during the COVID-19 pandemic.

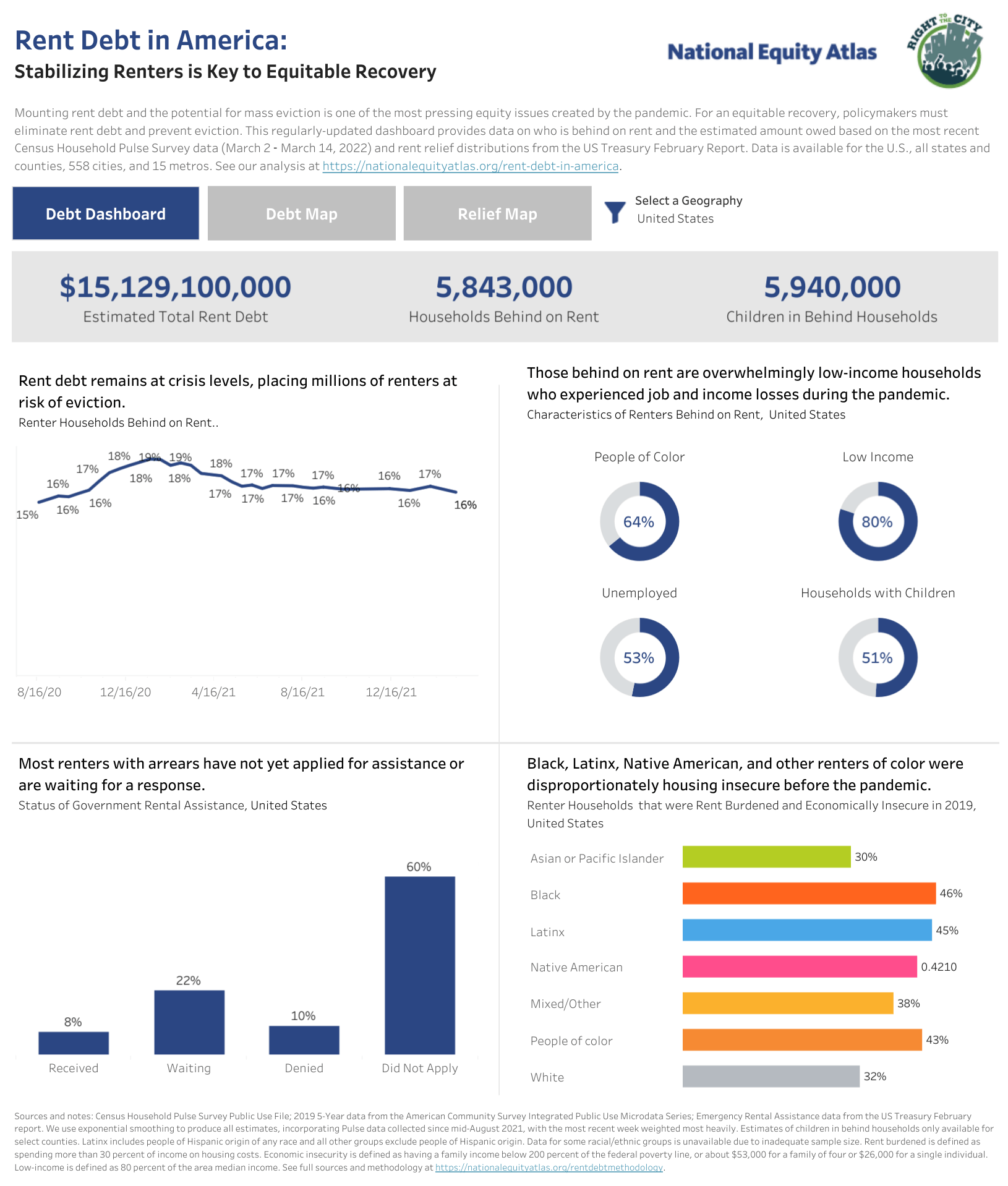

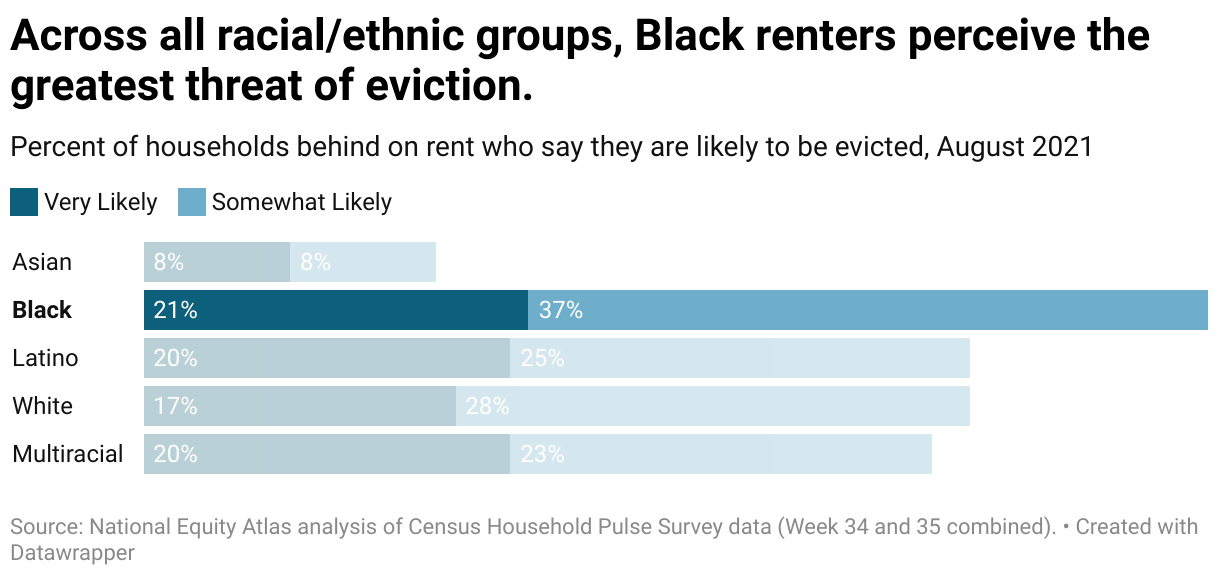

Mounting rent debt and the potential for mass eviction is one of the most pressing equity issues created by the COVID-19 pandemic. Low-wage workers — disproportionately people of color — who’ve suffered job and income losses due to the pandemic represent most of the millions of renters in debt. (See dashboard for characteristics of renters behind on rent. With the Supreme Court’s invalidation of the federal emergency eviction moratorium on August 26, 2021, and the lack of local moratoria in most places, those renters were facing imminent risk of eviction and homelessness.

The Rent Debt Dashboard was launched in April 2021 to inform policymaking and advocacy to prevent eviction and eliminate rent debt.

Produced by the National Equity Atlas partnership between PolicyLink and the USC Equity Research Institute, and in collaboration with the Right to the City Alliance — a network of community-based organizations working in 45 cities and 26 states to prevent displacement, expand affordable housing, and build just, sustainable cities for all — the Rent Debt Dashboard equips policymakers and advocates with data on the extent and nature of rent debt in their communities.

In addition to sharing this data directly with policymakers and related stakeholders, more than 200 local and national media articles have cited dashboard data to inform their articles about rent debt and pandemic recovery.

Explore the data

Throughout the Pandemic, eliminating rent debt has remained an equity imperative and a moral, economic, and public health necessity. Renters of color have been disproportionately impacted by the pandemic and were more likely to owe back rent, making them more vulnerable to eviction risk.

No rental assistance existed until December 2020 and by July 2021 only 11 percent of the funds were distributed. This left millions of renters in limbo. Data on the share of households behind on rent comes directly from the Census Pulse survey, which has been asking the question “Is this household currently caught up on rent payments?” every two weeks since mid-August 2020. Results revealed the following:

The CARES Act provided important unemployment benefits and cash assistance as well as an eviction moratorium that helped many pandemic-impacted renters, however, undocumented and mixed-status families were ineligible for assistance and the moratorium ended in July of 2020, leaving renters unprotected until the CDC enacted its moratorium in early September 2020. The CDC administratively extended the initial order three times: through March 31,June 30, and July 31, 2021. Absent meaningful financial assistance to pay back rent, the moratorium simply delayed eviction, yet the federal government provided no rent relief until December.

Amidst the continued spread of COVID-19, evictions will have disastrous impacts on public health: Research during the pandemic found that states that allowed evictions to proceed had more Covid infections and deaths than those with eviction moratoria. And particularly at a time when rents are increasing everywhere, eviction will increase homelessness, with its devastating consequences for health and well-being and significant costs for local governments.

- Rent was not the only debt accumulating for renters. The pandemic debt crisis extended far beyond their obligations to their landlords.

- Many renters borrowed from family and friends or took on other forms of debt in order to make rent and pay for household expenses.

- Among households behind on rent, 43 percent borrowed from friends or family to pay for expenses including rent, compared with 16 percent of households current on rent. About 31 percent of all renter households used a credit card (or some other form of debt) to pay rent. View Analysis.

Following the Advocacy Explorer approach, here is a look at the data advocacy approach PolicyLink and partners adopted in pursuit of their collective goal:

Stakeholder & Power Mapping

The steps of landscape analysis, stakeholder, and power mapping were completed before this particular advocacy need. PolicyLink’s stakeholders are established and consist of a large advocacy network that identifies policymakers nationally at the city, county, and state levels. The idea for gathering detailed rent debt estimates emerged as a response to the needs observed on the ground, by various community partners within the PolicyLink network. These local partners took the lead in identifying elected officials who sat on county boards, state budget committees, and those voting on the proposed rent relief legislation.

Example:Raise the Roof Coalition

Targeted Stakeholder: Contra Costa County, CA Board of Supervisors

Data to engage and advance policies: Fact Sheet: COVID-19 Evictions in Contra Costa County

Data Discovery

This data discovery journey started with a request by PolicyLink partner, Raise the Roof! Coalition, to estimate how many households were struggling with back rent and, therefore, at risk for eviction if the Contra Costa County Board of Supervisors allowed its eviction moratorium to expire. Another tenant advocate partner in San Mateo County suggested that having an estimate of how much back rent was owed would be helpful, and the Right to the City Alliance said that more access to the Household Pulse Survey would be helpful. The data discovery phase utilized the following sources:

- U.S. Census Bureau’s Household Pulse Survey (Number of households behind on rent)

- American Community Survey (ACS)

- PolicyLink created a new data point that estimates the amount of rent debt owed and the number of households behind for all states, U.S. counties, and 552 cities

Analysis for Influence

The estimates presented in the initial Rent Debt Dashboard included data gathered and analyzed before August 30, 2021. View methodology here. As the campaign evolved, the methodology was updated to include a larger number of geographic areas, being inclusive of the massive rent debt crisis, primarily driven by the pandemic’s economic fallout. Low-wage workers, who are disproportionately workers of color, were hardest hit by Covid-related job losses and are most vulnerable to suffering from rent debt. The pandemic exacerbated pre-existing housing insecurity for renters of color — especially women of color — who were already most likely to be rent-burdened and at risk of eviction.

With the update, the Rent Debt Dashboard now includes estimates of the number of renter households in all states and counties, 558 cities and census-designated places (those with at least 10,000 renter households), and 15 metropolitan regions. And as the federal relief programs started to provide support, the dashboard also described methods used for incorporating Emergency Rental Assistance data from the US Treasury into the “Relief Map.” View the full methodology.

The question of how many months the household is behind on rent was added in the Phase 3.2 Pulse Survey, beginning July 21, 2021. Prior to this question being added, national estimates of the distribution of rent arrears were derived from the University of Southern California’s Center for Economic and Social Research’s “Understanding Coronavirus in America” panel survey. The Pulse survey data was preferable for many reasons:

- It provides a much larger sample size

- It allows for cross-tabulations with the other Pulse survey questions

- It will be regularly updated at the same interval as our other data inputs

This shift to using the Pulse data on the distribution of arrears has had a significant impact on rent debt estimates, due to the higher share of households that are less than three months behind in the Pulse survey (as compared with the USC survey).

Rent debt estimates are now based on two sources of data:

- Household rent and income data from the 5-year 2019 American Community Survey (ACS) summary file and microdata

- Data on households behind on rent and the number of months behind on rent from the U.S. Census Bureau’s Household Pulse Survey microdata for the United States, all 50 states, including the 15 largest metros

Engagement for Action

PolicyLink created awareness for the Rent Debt Dashboard through the following engagement activities that included communications, PR, community outreach, and speaking at events.

- Press Release

- Media Outreach

- Email campaign to PolicyLink partner network

- Newsletter stories to the National Equity Atlas mailing list

- Shared via social media (Twitter and Facebook)

- Speaking engagements with stakeholders:

- Presentation to HUD research staff on September 15, 2021

- Presenter at the Minnesota Housing Partnership (MHP) State and Federal Legislative Updates Series on April 30, 2021

Impact

- Housing NOW! California statewide housing coalition used the data to advocate for strong eviction protections and successful implementation of the statewide Emergency Rental Assistance Program (ERAP).

- California Rental Assistance Program - The National Equity Atlas followed up on the Rent Debt Dashboard to produce a new CA-specific Tableau dashboard and analysis of the program based on the state's own program data, obtained through public records act request, in partnership with Housing NOW!.

- Data from the Rent Debt Dashboard informed the Hoosier Housing Needs Coalition’s calls for an ‘All-of-Government Approach’ to prevent evictions and for Indiana’s state and local policymakers to expedite the distribution of Emergency Rental Assistance.

- Minneapolis Housing Partnership created reports using PolicyLink data to inform their advocacy efforts:

- January Update: Minnesota Renter Data on Cost Burden and Rent Debt (January 2022)

- Minnesota Renter Data on Cost Burden & Rent Debt (December 2021)

- Over 200 local and national media articles were published.

- The White House Domestic Policy Council regularly used the dashboard (alongside their own estimates) to inform policymaking.

Conclusion

For Policylink and its partners, this successful advocacy campaign was powered by an intentional, methodical approach to the use of data in its advocacy. The collaborators were able to quickly draw out their landscape analysis to identify and map stakeholders and power brokers, convene those influencers, and clearly communicate--in part through locally-relevant data-- a shared vision for a policy initiative. What began as a data tool to assist those advocating for renters during the pandemic recovery, continues to impact public policy debates and concerns about the rent debt crisis in America.

The authors behind this work include Sarah Treuhaft, Michelle Huang, Alex Ramiller, Justin Scoggins, Abbie Langston, and Selena Tan.

Methodology

Explore the currentmethodology used for estimating the number of renter households behind on rent and the total and per household rent debt for the United States as a whole. This includes all states and counties, 558 cities and census-designated places (those with at least 10,000 renter households), and 15 metropolitan regions, as presented in the Rent Debt Dashboard.

View an archive of analyses that accompanied updates to the Rent Debt Dashboard. The most current analysis can be found here.

The methodology used before the August 30, 2021 update can be found here. You can also view full Methodology with March 15, 2022 updates here.