Salesforce Streamlines Finance Operations and Identifies Cost Savings with Tableau Cloud

Visualizing complex finance data improves allocation of company resources

Identifying trends in employee expenses delivers vital cost savings across the business

Surfacing key financial insights enables budget leaders to act quickly and decisively

Salesforce’s Finance team uses Tableau to simplify, inform and optimize its everyday operations. The team's actions have company-wide implications, so what begins as a positive impact on cost management soon transforms into key insights that inform how to direct resources, respond to challenges, and formulate sales strategies.

The Challenge

Tackling data disarray, transforming spreadsheets into strategy

In 2019, the Finance team at Salesforce was a 1,000-person organization struggling with its data. There was no clear data strategy, with finance data coming from multiple tools and systems. Different people were running reports and working in silos, while attempting to manage and analyze complex datasets in spreadsheets. This resulted in data inaccuracies, inefficient uses of people’s time and strategic skills, lack of visibility, and no sources of truth that the team could trust.

Salesforce - like many companies - had been struggling with significant challenges following the pandemic, ranging from supply chain disruption and inflation, to the effects of higher interest rates and overall market volatility.

Another challenge Salesforce faced was a complex technology ecosystem. With over 100 finance applications powering global operations, the Finance team regularly needed to combine data from those disparate platforms in order to surface valuable insights. As the volume and variety of this data grew over time, identifying relevant information and trends became more and more difficult to achieve.

Salesforce’s Finance team also needed a strong data governance strategy to ensure data quality, understand what data was available and its lineage, track and document transformations, and control access to the data - particularly with sensitive information such as employee compensation.

The Finance team knew it could use data to monitor controllable costs and yield tremendous savings, but lacked the tools. The acquisition of Tableau was an accelerator on its data analytics journey.

How Tableau Helps

Tableau has helped Salesforce’s Finance team generate benefits across a range of key areas, including:

- Aligning hiring strategy: Monitoring actual hiring against targets in near real-time, and being more intentional about aligning headcount with Salesforce’s product and marketing strategy.

- Reducing expenses: Visualizing expense data has helped change spending behavior, generating significant cost savings as a result.

- More effective sourcing and procurement: Seamless data discovery in Tableau allows Salesforce’s Global Procurement & Sourcing (GPS) team to act quickly and decisively.

- Sharing key performance metrics: Making KPI insights available and actionable in easily digestible dashboards enables leaders across the business to make more informed decisions.

Combining headcount data to drive growth and smarter hiring decisions

With 70,000 employees worldwide, tracking and maintaining this large hiring ecosystem and aligning it with business priorities is a huge task. Salesforce has been able to use Tableau to dramatically improve the headcount management system and processes efficiency.

Using Tableau Prep’s ability to combine data from multiple sources, the Finance team can now blend data from HR’s instance of Workday with data from our forecast. Doing so enables the team to monitor actual hiring against planned headcount, both historically and in near real-time, taking the guesswork out of employee management.

A dedicated headcount dashboard enables Salesforce team members to self-service their own analytics needs, meaning less back-and-forth between HR and Finance. Easy access to insights into headcount activity, such as spending, hires, transfers, and terminations means the Finance team can now quickly tell which department - right down to the cost center - is under, approaching, or going over its hiring target.

Highlighting the data in this way includes counterintuitive benefits. For example, being under target for hiring can be a red flag as it may indicate some positions are particularly hard to recruit for, meaning remedial action must be taken. Insights like this - which often go undetected in spreadsheets - are now readily apparent because of how fast and easy it is to visualize data in a Tableau dashboard.

For example, Salesforce's Finance team can use Tableau to compare headcount distribution across different products/markets and determine whether or not the current headcount allocation is aligned with the company's strategy.

If Salesforce is focusing on a certain product or geography, the Finance team can see if the allocated headcount supports this and make strategic adjustments if necessary. This level of insight helps Salesforce be more intentional about where it invests in human resources.

Visualizing spend data to drive cost savings

All companies need to keep a tight hold on costs and Salesforce is no different. But with such a large, global, mobile workforce, Travel and Entertainment (T&E) costs can quickly spiral. The Finance team is now using Tableau visualizations to keep them under control by providing leaders with insights into T&E spend and how it is tracking against budgets.

For example, if the Finance team sees in the dashboard that the company is significantly above its travel budget for several months in a row, it can use this information to make a company-wide decision on how to reduce these costs.

With Tableau, the team can quickly identify duplicate spending - such as on hotels, air travel, and more - fix anomalies proactively and inform leadership promptly.

Surfacing T&E spend insights with Finance business partners is crucial to hold leaders accountable to their budget. Business review meetings used to be run with Google Slides or PowerPoint, but now the team leverages Tableau stories, replacing static screenshots with dynamic visual storytelling. By staying within Tableau, the team can continue to interact with Tableau’s features and answer any questions live, instantly bringing the conversation to life.

Visualizing data from the Salesforce’s travel bookings and corporate credit systems enables the Finance team to monitor spending behavior and ensure travel and expense costs stay within company guidelines. These dashboards help answer additional questions such as the following:

- How many times is a team in excess of guidelines when it comes to hotel rates and meal expenses?

- How many flights have been booked at the last minute at a greater expense?

- How much T&E relates to customer-facing versus non-customer-facing?

For the Finance team, this makes it much easier to evaluate T&E spending habits over time and estimate savings from certain actions, such as freezing non customer-facing travel.

But direct action isn't always necessary. The Salesforce Finance team reports that simply knowing this data and these dashboards are available organically shifts employee spending mindsets and behavior, leading to cost savings across the business.

Proactively tracking sourcing and procurement

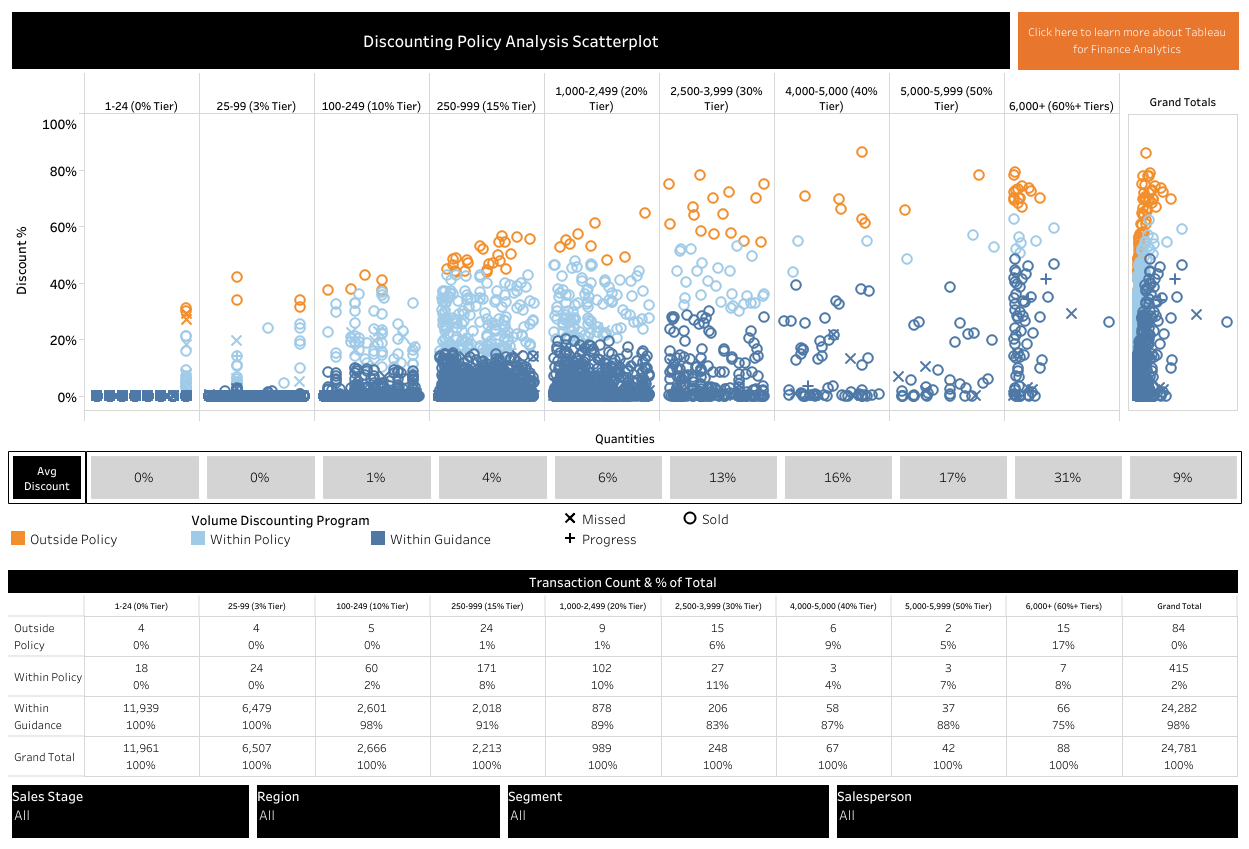

The Salesforce Global Procurement & Sourcing (GPS) team leverages Tableau to surface trusted insights, empowering better negotiation terms with suppliers, increased cost savings, improved operational efficiency, and better informed decisions. Explore Procurement Contract Savings vs. Contracts to learn more.

The team built a curated "dashboard of dashboards," also known as the Procurement Landing Page, to ensure seamless data discovery and promote the use of secure, governed content for consistent and reliable insights. Tableau helps the GPS team see, understand, and act on their data by enabling:

- Comprehensive spend visibility: Deep insights into invoice costs by region, spend category, commodity, and supplier enable better negotiation and cost savings. Leveraging filters and parameters, Tableau provides the flexibility for a single dashboard to offer valuable insights to diverse personas, ranging from leaders to sourcing managers and individual contributors.

- Performance monitoring: Tracking crucial KPIs like annualized contract savings measures the financial savings driven by the team through improved negotiation terms.

- Strategic project management: Visualizing sourcing projects and agreement timelines with Gantt Charts ensures visibility into the team's priorities and proactive management of expiring agreements with suppliers.

- Streamlined workflows: By gaining visibility into where pending purchase requisitions (PRs) are in the approval lifecycle, leaders can better gauge timelines and secure their approval faster, resulting in faster PRs to purchase orders (POs) processing. Likewise, understanding the turnaround time of each step in the supplier onboarding process means inefficiencies can quickly be pinpointed and addressed, resulting in improved supplier relationships.

Ultimately, Tableau equips the Salesforce GPS organization with the data-driven agility needed to optimize spend, save costs, enhance supplier relationships, and achieve operational excellence.

Saving valuable time and resources in FX risk management

Foreign Exchange (FX) volatility is a risk resulting from international operations. Salesforce has a team responsible for identifying the daily transactions that create foreign currency exposures and trading foreign currency contracts to hedge that FX risk.

Before Tableau, that process was very manual. It would take the FX Risk Management team up to three hours every day to manipulate the data in spreadsheets, with a lot of back and forth needed within the source systems to drill down into entries.

Now, the Finance team has an array of workbooks connected to near real-time general ledger data, with the relevant fields for the analysis.

The significant time savings have enabled the team to finish the analysis much earlier during the day, allowing them to trade while both the New York and London markets are open, resulting in better trading terms and reduced operational costs.

It’s also much easier to exclude entries that are not in scope for hedging and much faster to investigate the data, which has significantly increased the accuracy of the hedging process.

You don't need to be a wizard or data scientist to use Tableau. It has a very intuitive interface. Drag and drop, no code. In just a few clicks, you can perform ad hoc analysis to answer the next business question and gain real insight from your data.

The Tableau Difference

The adoption of Tableau has freed Salesforce’s Finance team from relying on highly-manual, time-consuming, and error-prone spreadsheets. The insights Tableau provides help to highlight what would otherwise be business blind spots, which directly impact financial decision making across the business.

The easy-to-understand visualizations make financial data and insights accessible, empowering the Finance team to present their case for cost-cutting or targeted spending to executives and budget leaders.

Presenting these actionable insights during monthly business reviews helps leadership make fully informed decisions and proactively problem solve for the future. Widespread access to Finance dashboards, granted to employees with the appropriate level of clearance, enables them to self-serve their analytics needs and positively change their spending behavior.

Through the adoption of Tableau, Salesforce’s Finance team has been able to evolve into a more proactive, strategic, and collaborative partner with every other department across the business.

We need to evolve beyond simply pulling information from dashboards and leverage Tableau Pulse to push actionable AI-powered insights directly to leaders. We can't overlook the crucial step of human review of the AI's output. With Tableau Next and Salesforce's deeply unified platform, this progression will lead to intelligent agents capable of responding to human questions via conversational interfaces and acting autonomously on the data.

A peek into the future

Salesforce's Finance team is committed to pushing the boundaries of what's possible with data and in doing so setting the standard for how organizations can leverage finance data and analytics to drive business results.

In the future, they will bolster their capabilities with powerful AI innovations like Tableau Pulse to further scale data-driven decision making by delivering personalized insights to every member of the team and Tableau Agent to help analysts turn data into insights even faster.

The team is particularly excited to bring Tableau Next into the fold. With powerful agentic analytics capabilities, Tableau Next will empower the team to go from data to actionable decisions faster than ever before.

See how Tableau is leveraged by finance departments by visiting tableau.com/solutions/finance-analytics and exploring Tableau for Finance on Tableau Public.