3 resolutions for finance leaders in 2019

The closing of the previous fiscal year and the start a new one means establishing finance resolutions to take advantage of your organization’s digital transformation efforts. As technology continues to rapidly evolve your company and the finance function, CFOs are faced with integrating these technologies powered by advanced analytics, in order to run a truly data-driven office of finance. According to the EY publication The DNA of the CFO, "CFOs must actively investigate how they can use sophisticated, forward-looking analytics to enhance their organization’s performance." Taking practical steps to make finance more technically agile means improving speed to insight: getting answers to business questions faster.

As a finance leader, you serve as a consultative partner—your team is responsible for supplying financial data to other lines of business. Key stakeholders come to you with critical questions about the company's finances and you're expected to give them answers, quickly. The information you provide is only as good as the data you have, the technical platforms used to extract insight, as well as the analysts you've hired. To get deeper visibility into enterprise performance from advanced analytics, commit to making these your finance resolutions for the year:

- Create a single source of truth for every finance function.

- Establish a center of excellence to positively impact the business.

- Automate processes for better efficiency as a method for attracting the best talent.

Resolution 1: Solve for challenges with a single source of truth for each function

Everything from internal audit functions to FP&A to reporting can benefit from the integration of technologies. This shifts finance staff from doing manual, time-consuming reporting, to focusing on strategic forecasting, planning, and uncovering fraud. According to KPMG, having advanced analytics in place means financial analysts can more quickly share insights with business partners. To take action before their budgets and financial statements are negatively affected provides greater value to your business.

A major challenge is connecting disparate data across systems, such as ERPs, Banking Statements, Procurement, HR, and Travel and Expense. It's likely that your accountants are exporting large amounts of data from these various sources into Excel, which does not indicate connection to a live data source. During open accounting periods, your data is changing often, and being reviewed and analyzed by various people simultaneously. To maintain accurate and current data, focus on business intelligence solutions to create validated, current, and secure financial data—a single source of truth for the office of finance. Look for technical platforms that allow you to:

- Connect to multiple data sources (e.g., NetSuite, Salesforce, Concur, Anaplan, etc.).

- Allow for data blending and cross-database joins.

- Automate recurring processes.

- Connect to a live data source.

- Maintain data governance and security.

- Create alerts and subscriptions for different levels of access.

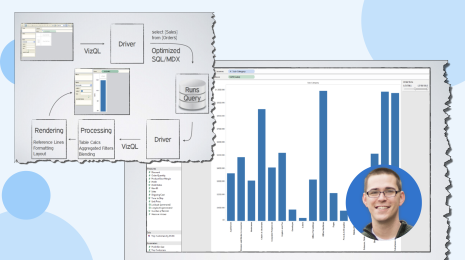

A single source of truth for every finance function saves your staff valuable time and energy, because they don’t have to check which data source is correct or secure. Now your team can create reports and dashboards from validated, trusted data for stakeholders to view on their own. Self-service dashboards alleviate additional demands on your finance team, facilitating improved predictions and forecasting of trends. Imagine being able to access information from systems such as Travel, Expense, Procurement and Banking statements at the same level of detail as your General Ledger. Learn how the Tableau Finance Analytics team does this, along with ad-hoc analytics, to create data-rich, self-service dashboards for their stakeholders with this webinar.

Resolution 2: Establish a Finance Center of Excellence

This is the year to create a Center of Excellence (CoE) to focus on education and make the office of finance a more effective strategic advisor to your enterprise. A recent Global CEO Outlook study found that "Fifty-four percent of Business Executives believe that a better ability to analyze data would help to improve decision-making within their organizations." A CoE with advanced analytics capabilities at its core would be uniquely positioned to support business functions by creating deeper visibility into financial performance with executive and partner dashboards, while also identifying risks and improving forecasting or planning.

The Finance CoE will be the single team to manage finance data sources, handle data quality and data prep, and build out a program to establish finance analytics best practices to improve operational efficiencies. We’ve witnessed how this can mature your finance analytics organization, moving beyond adoption to help your company increase engagement of analytics, and thus increasing decisions based on data.

For establishing a Tableau CoE, check out this webinar.

Resolution 3: Improve operational efficiency to secure the best talent

Every accountant or financial analyst has manual processes to complete, especially when at the month, quarter, or year end. As a finance leader, you have the opportunity to institute processes and technology to improve your staff’s workflows and impact to the business. Improving operational efficiencies helps your team do strategic, proactive work that affects the bottom line, like identify or predict fraud, consult with stakeholders, and forecast financial performance accurately.

By using a business intelligence platform like Tableau that allows for advanced analytics, your department can eliminate manual, recurring processes that leads to faster closing each month end. Saving your analysts time on processes that can be automated means they can focus on analyzing cash flow, finding ways to cut travel expenses, management procurement contracts, and spotting trends and outlier behavior. This can mean the difference between hiring and retaining top-tier or second-tier talent. You need the brightest finance professionals to answer stakeholder questions quickly and accurately, and you want them engaged in meaningful work, rather than repetitive tasks.

By tackling these three challenges, you’ll get answers to business questions faster and drive value for your enterprise. Discover how to bring your finance data together for a single source of truth for every function and provide powerful analytics and reporting to stakeholders with these additional resources.