Precisely Imprecise: The Art and Science of Being Non-Specific

TCC11 is over, but the recap isn't. Jetlagged and tired Software Engineer David Dunham sent in this on Paul Kedrosky's talk, which got rave reviews on Twitter and from attendees.

Sitting in the back of the room, at first I thought that Paul Kedrosky said that "Vegas gets a bad rap." Then I realized he was talking about "vagueness." Fortunately, I found the rest of his talk clear, entertaining, and informative.

He began by noting that "Telly Savalas has a place in the vagueness literature." Everyone knows he's bald. If you add one hair, is he still bald? Sure. What about another hair? And another? The n+1st hair doesn't change him, he's still bald. Further, all of us, like Bill Gates, are rich. (Take away $1 from his wealth and he's still rich…) And we're still on Mt Everest (descend one µm at a time and you're still at the summit). Looking at it from the other direction, when does a grain of sand become a heap as you keep adding grains?

Somehow people can cope with vague notions, even though the above doesn't make sense on one level. In fact, 75% of people think they're good drivers. That number goes way down if you ask them if they're good at parallel parking. We're much more confident about our prowess at vague skills ("good driver") than specific ones ("parallel parking") where we have something to measure ourselves against. By the same token, everyone knows they couldn't beat Usain Bolt in a sprint — a specific skill. But when asked "is he as hard-core a sportsman as you?" about half of the respondents in a survey disagreed. (How would you know?)

Kedrosky then moved to financial markets. To them, "the iPhone is just a mall, where suppliers are stores that have some square footage." Like in high school, they want to know who's in and who's out? So when the iPhone 4S was released, the disassembly specialists used a microscope to discover that the previous image sensor supplier, OmniVision, was now out. OmniVision got shellacked in the stock market. But then people speculated that perhaps Apple wasn't using a single supplier. OmniVision share prices started to recover, but then sagged on confirmation. In general, as information comes out, there are wild oscillations in the market. We pretend to more precision than we have.

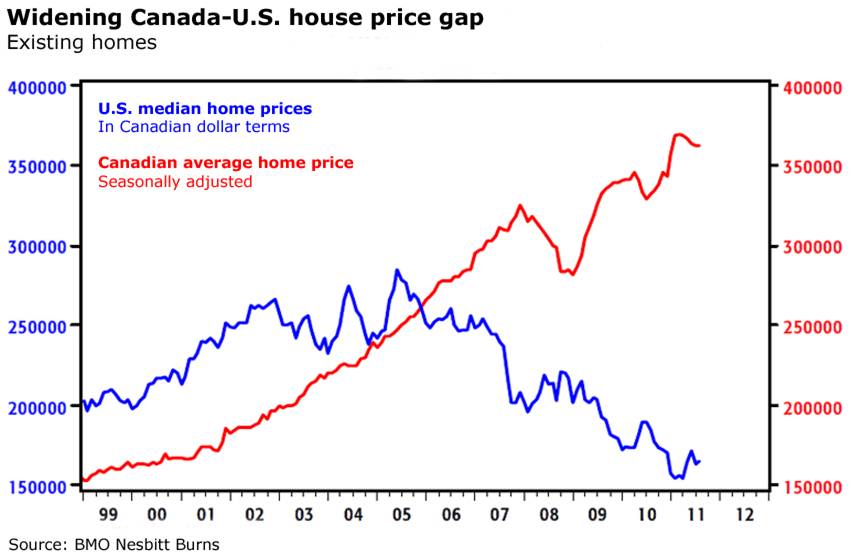

Visualizations may be composed of very precise data, but actually be vague. This graph doesn't really say anything meaningful (it confounds currency differences and compares a median to an average). But the charts influenced Canadian legislation.

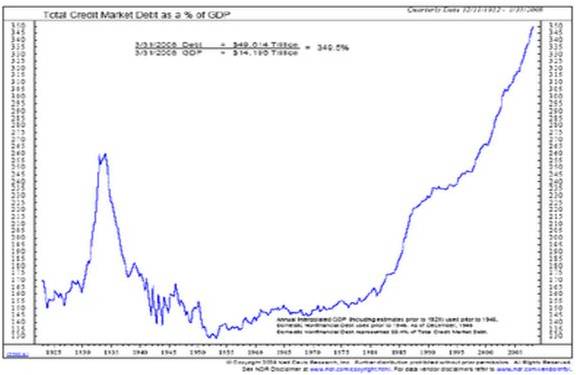

And this graph, which was widely circulated during the financial crisis can't really be precise, since it pulls together six different time series that weren't intended to be coordinated. Ignoring this problem, it was intended to be used in a prescriptive way. But in fact, the n is two — we have only seen a situation like this two times. Or maybe even only once — all we really know is that the other time we were in a situation like this, bad things happened.

Kedrosky then discussed what purported to be a study of weight loss. The control group tracked their numerical BMI (body mass index), while the test group was told a fanciful indicator with vague values. "The group that lost the most weight was the group with the fuzziest information." The study, "In Praise of Vagueness" found that people performed much better with imprecise knowledge in a number of domains. "This runs counter to so much of what we're doing with dashboards."

Finally, by doing a word analysis on http://isitnormal.com/, he showed that people's concerns are vague ("love," "feel", "like"). We should remember that so much of what's important to us is wildly vague.

The session concluded with some lively Q&A. Discussing behavioral economics ("stupid human tricks"), Kedrosky wondered if humans were really the luckiest coin flippers on the planet, or if there's something about our heuristics that make us adaptable. They're actually features, not bugs. An audience member suggested that people perform better with vagueness because when they have a range, they're free to explore. Kedrosky pointed out that one of the reasons Fukushima was so calamitous to the world economy was that supply chains were shrunken to zero. There was no slack in the system, because of the fetish of empiricism. It's too early in the study of vagueness to give guidelines on when things should be vague and when not. But once you realize that specific values aren't meaningful, you shouldn't become anarchic. Show some humility. And reintroduce slack to the system.

Subscribe to our blog

Ontvang de nieuwste updates van Tableau in je inbox.